By 31st of March 2025 report issuers, analysts, investors, and other stakeholders are invited to submit their feedback regarding the suggested technical requirements to the sustainability tagging and the suggested evolution to the existing block tagging of the notes.

This consultation paper covers:

- Proposal for phased rollout of ESRS tagging

- Proposal for Article 8 tagging

- Architecture of the ESEF taxonomy including Article 8 and ESRS

- Proposal for changes to tagging of the Notes to the Primary Financial Statements

Main takeaways:

- ESMA is planning to reduce complexity in tagging. Nested tagging and multi-tagging must be avoided, tables in the notes should be tagged individually.

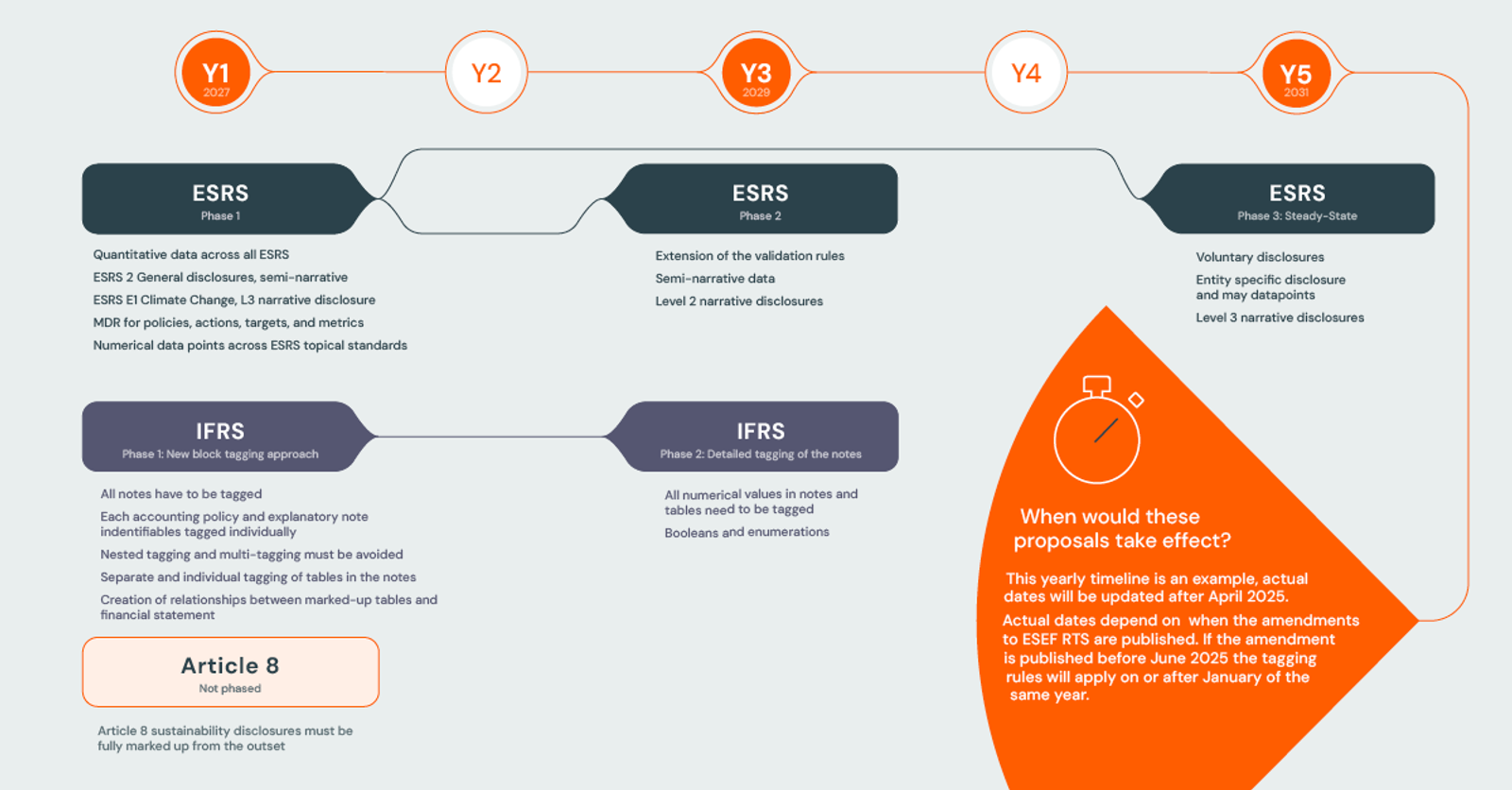

- If technical requirements are published in the Official Journal before June 2026, Article 8 requirements and Phase 1 requirements for ESRS and IFRS will take effect in 2027.

- If technical requirements are published after June 2026, Article 8 and Phase 1 for ESRS and IFRS will take effect in 2028.

- Phased roll out of requirements for ESRS and IFRS introduces clarity and provides time to report issuers to make sure they have right tools and knowledge to produce compliant annual reports.

When would these proposals take effect?

That depends on when the Official Journal will publish the amendment to ESEF RTS.

If the amendment is published before 30 June, the tagging rules will apply to financial years (FY) starting on or after 1 January of the same year. This means that the report issuers will have about 6 months to prepare for the new compliance requirements for annual reporting. The marked-up reports will be published in the following year.

Proposal for phased rollout of ESRS tagging

To ease the burden on the companies, ESMA proposes a phased implementation for marking up the sustainability reports. Thus will be over three phases with each lasting two years.

Phase 1

Timeline: Begins in year N or N+1, depending on the publication date of the ESEF RTS amendments in the OJ.

Focus:

- All disclosures under ESRS 2 “General disclosures” and ESRS E1 “Climate change”

- Data points related to Minimum Disclosure Requirements (MDRs).

- IRO-1 related data points across all topical standards.

- Data points referred to as “EU data points”.

- All data points with corresponding numerical, string, and date XBRL elements.

- Narrative disclosures using principle-based Level 1 ESRS disclosure text block markups.

Phase 2

Timeline: Two years after the initial implementation (Year N+2).

Focus: Expanding marking up to include:

- Semi-narrative disclosures (Boolean or enumeration data types).

- Narrative disclosures using Level 2 ESRS disclosure text block markups, providing more specific information.

Objective: Increase the granularity and comparability of sustainability data.

Phase 3: Steady-State

Timeline: Four years after the initial implementation (Year N+4 or N+5).

Focus: Comprehensive marking up, including:

- All data points, including those related to “may” disclosure requirements.

- Entity-specific disclosures using appropriate taxonomy mechanisms.

- Narrative disclosures using Level 3 ESRS disclosure text block markups, achieving the highest level of detail.

Objective: Achieve full digitalisation of sustainability reports, making the human-readable version identical to the machine-readable version.

It is important to note that companies can voluntarily implement subsequent phases ahead of schedule or mark up additional information, as long as it doesn’t conflict with existing rules or obscure required disclosures.

Article 8 must be marked up from the outset

Article 8 uses a closed taxonomy, meaning no modifications to the templates or entity-specific extensions are permitted. The templates are standardised and tailored to various types of undertakings, including non-financial institutions, asset managers, credit institutions, investment firms, and insurance or reinsurance companies. This standardisation promotes comparability and simplifies the reporting process.

The content is predominantly numerical, with some narrative elements included to provide context for the numbers.

Unlike the phased approach adopted for marking up ESRS disclosures, Article 8 sustainability disclosures must be fully marked up from the outset.

Proposal for changes to tagging of the Notes to the Primary Financial Statements

Significant changes to the tagging of the Notes to the IFRS consolidated financial statements in ESEF reports are proposed in this consultation. These revisions aim to improve the usability and comparability of the disclosed information, address feedback from issuers and users, and align with the approach for marking up sustainability disclosures. These changes will make the digital reporting more useful for European Single Access Point (ESAP) and enhance comparability of financial information.

Under the current RTS on ESEF, issuers are required to mark up sections of the Notes using a list of mandatory core taxonomy elements, primarily in the form of text blocks. This approach has been criticized for being complex, burdensome, and resulting in inconsistent application of markups.

To reduce the burden on issuers while also enhancing the comparability of financial information, ESMA proposes phased rollout of the following changes:

Phase 1 - New block tagging approach:

- Each accounting policy and other explanatory disclosure that is individually and separately identifiable in the Notes should be marked up with one core taxonomy element that best represents the accounting meaning.

- Nested or multi-marking should be minimised.

- Each table in the Notes to the IFRS consolidated financial statements should be marked up separately.

- Creation of relationships between the marked up tables and the corresponding XBRL elements in the primary financial statements by using the corresponding fact-to-fact relationships defined in the IFRS core taxonomy.

Phase 2 - Detail tagging of the notes:

- Implement detailed tagging of numerical elements such as monetary values, decimals, dates, integers, and percentages.

- Additionally, semi-narrative disclosures (Boolean and enumeration item types) should be marked up.

ESMA proposes to remove the current list of mandatory Text block elements while introducing a list of new items about the issuer as well as the audit firm. The proposal also includes revised guidelines for creating extension taxonomy elements while encouraging issuers to minimize their use.

Recommendations for businesses

The modifications to the tagging of notes, including the reduction of multi-tagging and the incorporation of detail tagging elements, are pivotal in enhancing the readability and clarity of reports, thereby minimising the user's workload and optimising the quality and usability of the tagged notes

The ESRS approach is meticulously structured, yet it encompasses a substantial volume of data, necessitating a heightened level of attention to data collection and report structure. This will assist in gradual adaptation to impending changes and alleviate stress commonly associated with reporting.

Article 8 introduces a templated approach to annual report tagging which facilitates compliance with regulations.

The disclosed approach for the ESEF taxonomy which will encompass Article 8 and ESRS taxonomies in addition to the IFRS taxonomy clarifies the future of ESEF requirements.

You can find the full text of the consultation paper on the ESMA website.